Would you rather buy gold at $3,600 an ounce, or buy a house in Seattle with mortgage rates at 6.5%?

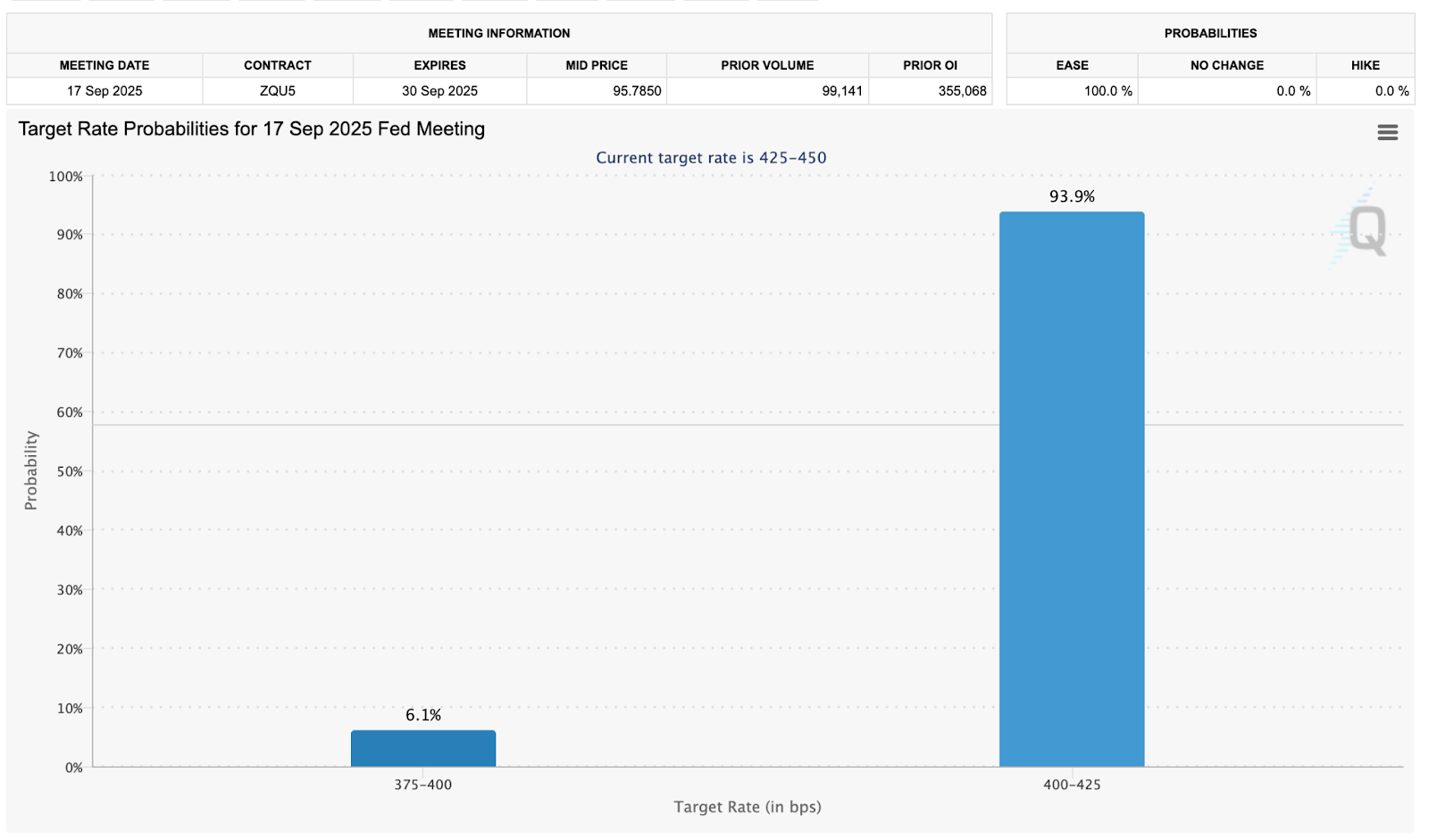

That’s the choice many people are facing right now, as the Fed prepares to cut rates on September 17th. Gold is at record highs, and the market is shifting fast.

So the real question is: will this spark another wave of inflation, and is real estate still worth it?

In this article, we’ll break it down. First, the latest data from Seattle and King County — what’s happening with prices, sales, and inventory.

Then, why the Fed has no choice, how markets are reacting, and what the Merrill Lynch clock tells us about the economy.

Finally, what this means for buyers, sellers, and investors, and how to position yourself.

📊 King County Housing – August Data

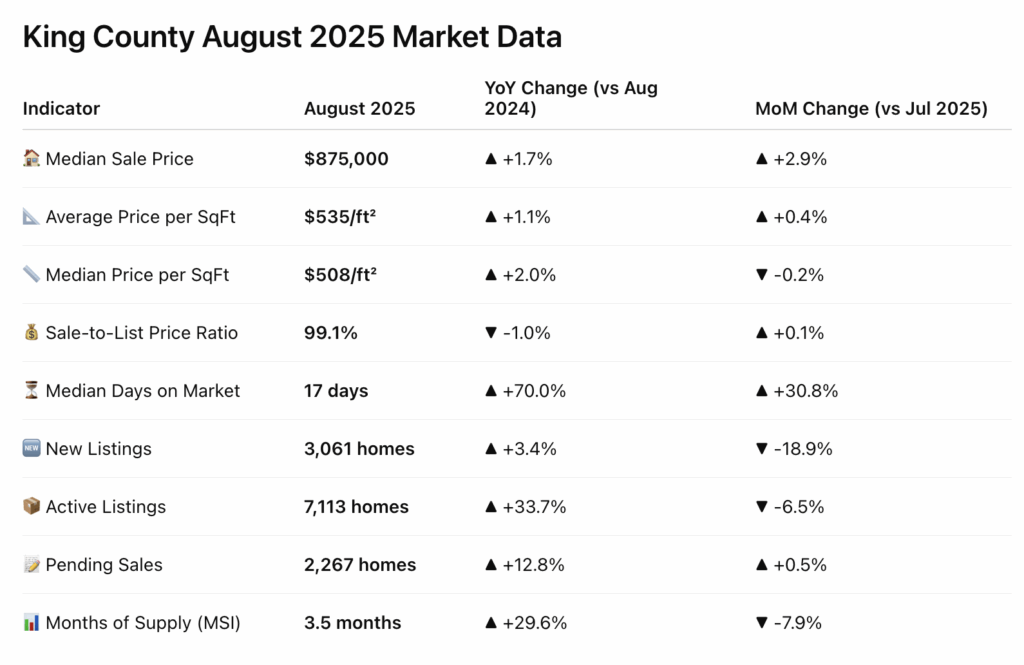

King County’s August numbers tell a very interesting story.

The median home price came in at about $875,000, up 1.7% year-over-year and slightly higher than July. Average price per square foot was $535, up about one percent. The takeaway? Prices have stopped falling and are beginning to stabilize.

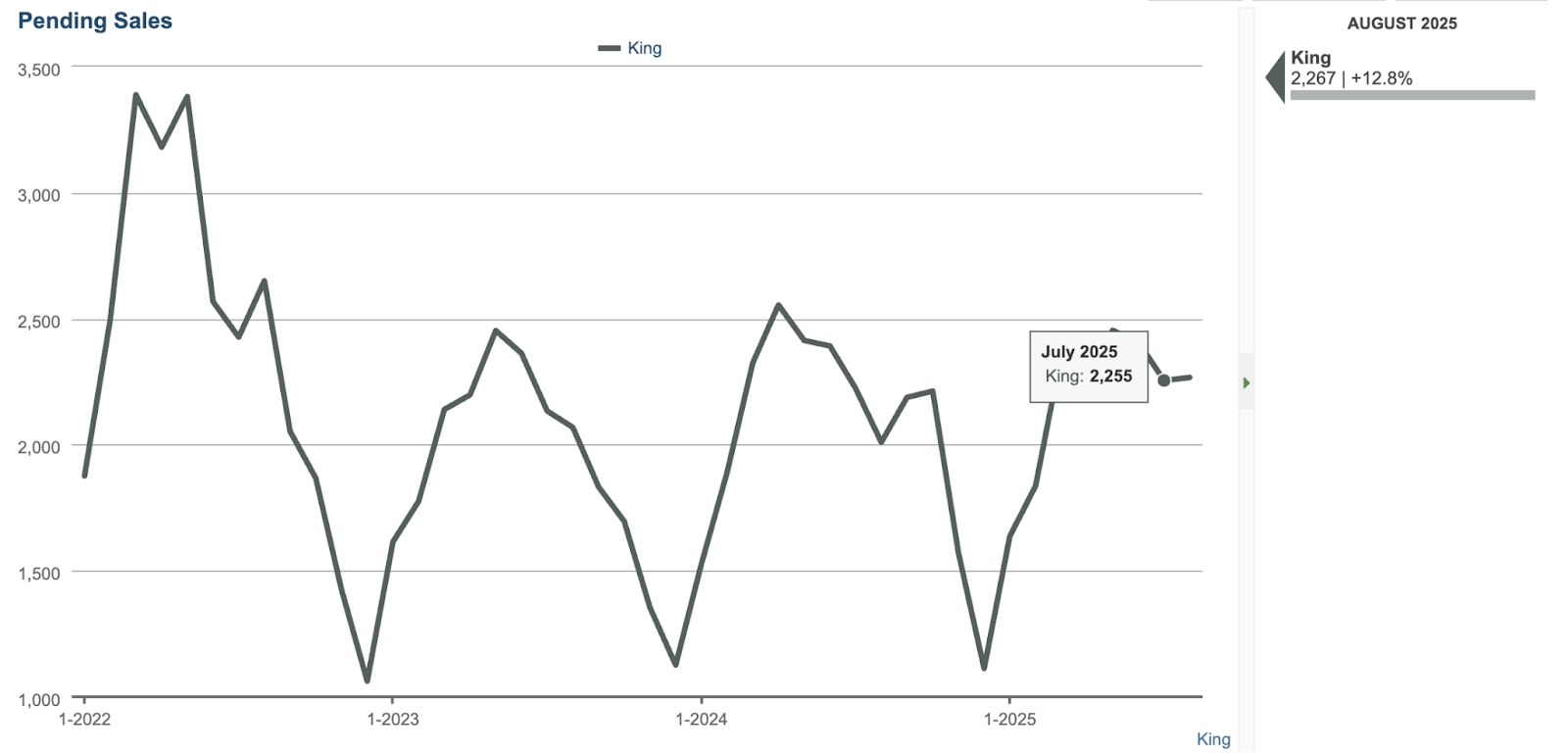

Pending sales were strong: 2,267 homes went under contract, almost 13% more than a year ago, and even a touch higher than July. So buyers are coming back.

But the median days on market stretched from 13 days in July to 17 in August. That means homes are still taking longer to sell, even though more buyers are stepping in.

And here’s the twist — new listings were 3,061, but active inventory actually dropped, from 7,608 homes in July down to 7,113 in August. Months of supply fell from 3.8 to 3.5. How does that happen? It means a lot of sellers are pulling homes off the market — either they didn’t get the offers they wanted, or they’re waiting for better conditions.

So when you put it all together: prices are stabilizing, pending sales are rising, and inventory is shrinking. That combination points to a market that’s shifting from sideways into a weak recovery.

And we’re already seeing it: the best homes — good schools, good locations — are moving faster again. If you wait too long, you may lose your chance to negotiate.

🌐 Rate Cuts, Market Reactions, and the Merrill Lynch Clock

Now let’s zoom out.

The Fed. They don’t want to cut, but they have no choice. Unemployment just ticked up to 4.3%. GDP forecasts are down to 1.4–1.5%. And core inflation has been stuck at 2.8 to 3% for three months. That’s stagflation — slowing growth, stubborn inflation, rising unemployment. It’s the worst mix.

That’s why the market is betting so heavily on a cut. And that’s why mortgage rates are already easing.

So how are markets reacting? Let’s look at the past few weeks — it’s textbook.

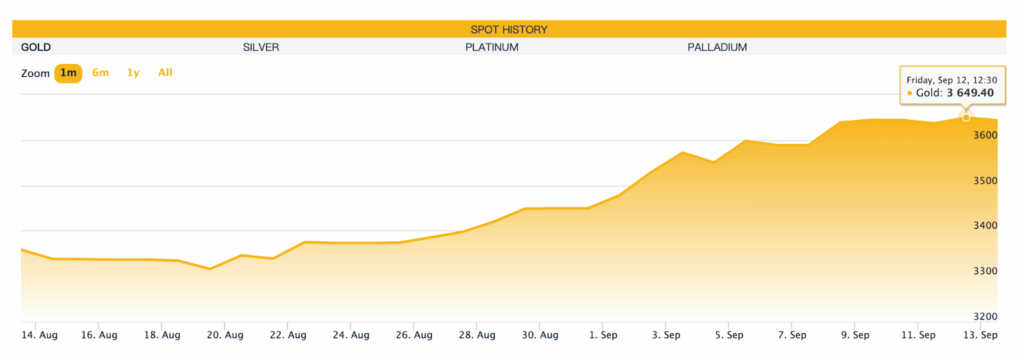

Gold blasted over $3,600 an ounce in early September 2025, hitting a new all-time high. Silver climbed to nearly $30, the highest since 2011.

The 10-year Treasury yield, which was above 4.3% in July, has now dropped below 4%, showing investors are piling into bonds.

The U.S. Dollar Index, which peaked around 109 last year, has slid to 97–98 by mid-September.

And the S&P 500 has bounced more than 7% from the July lows, led by tech stocks, with the Nasdaq up even more.

Investors are moving money out of cash and dollars, into anything that looks safer or that can hold value.

If you look at the Merrill Lynch investment clock, the U.S. is moving from stagflation toward recession. That quadrant favors commodities like gold and silver, and bonds.

Real estate is more complicated. It doesn’t spike overnight — it lags, and it splits.

In the short term — three to six months — buyers gain confidence, pending sales pick up, exactly like we’re seeing in King County right now.

In the medium term — six to twelve months — the best properties recover first. Prime locations, good school districts, unique homes. Just last month we saw it first-hand: a high-priced older home in Bellevue’s 98004 sold quickly. And another one in 98006? Buyers added $50,000 over asking and still lost.

At the same time, cheaper suburban homes are sitting on the market. That’s real-time market split.

And in the long term — one to two years — if rate cuts trigger another wave of inflation, costs will climb again: materials, labor, even mortgages. That means housing could keep moving higher, but slowly, and with big differences between the winners and the laggards.

🔑Buyers, Sellers, Investors

So what does this mean for you?

If you’re a buyer, here’s the truth: don’t wait for the Fed meeting. By the time they announce the cut, competition for the best homes will already be back. We’re seeing jumbo loans getting locked near 6%, ARMs at 5.5% — lower than the headline averages. If you find the right home, and the numbers work, act before the herd comes back.

If you’re a seller, especially with a good property in a strong location, list it. Demand is here for those homes. Remember the Bellevue case — fifty thousand over asking wasn’t enough. That’s how competitive it can be when the property is right.

But if your home needs repairs, or it’s in a weaker area, don’t rush. Take the time to get it ready and consider the spring market.

And if you’re an investor, you need discipline. Run your cash-flow models. The rental market isn’t as hot as before — vacancies are a little higher, rent growth has slowed. Be conservative, and don’t assume rising prices will save you.

🎯 Summary

So here’s the bottom line: rate cuts are coming — not because the economy is strong, but because it’s weak. Gold and silver already know it. Stocks are running with it. And housing? Housing is waking up, but it’s split — the best homes are moving first, the rest are still waiting.

That means if you’re buying, now is the window to act before competition heats up. If you’re selling, lean into your home’s strengths. And if you’re investing, stay disciplined, focus on cash flow, and pick your spots.

Now I want to hear from you: if you had $200,000 right now, would you buy gold, or put it toward a house? Tell me in the comments below.

And if this article was helpful, make sure to hit the like, or share it to your friends. I’m Maggie, and I’ll see you in the next one.