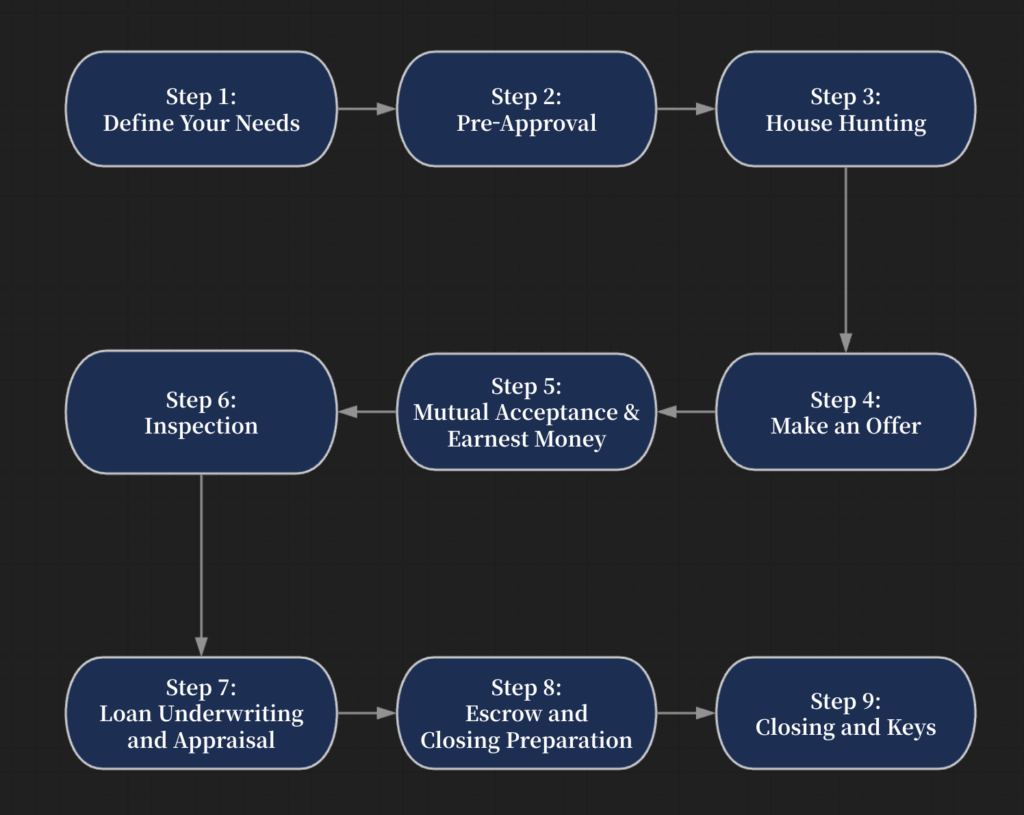

Recently, we realized that despite all this time, we have never systematically covered the complete process and true costs of buying a home in the United States.

In this article, I will break down the entire process for you from start to finish. After reading it, you will understand: What steps are involved in buying a home? What documents need to be prepared at each stage? And approximately how much money is required?

💬 Step 1 | Define Your Needs

When it comes to buying a house, there’s no need to rush into viewing properties right away. The first step should be to clarify your own requirements. Especially if you have a partner, it’s advisable to sit down together first, align your thoughts, and avoid potential disagreements later.

You can categorize your needs into two types:

- Must-Have: Such as budget range, number of bedrooms, school district requirements – these are non-negotiable.

- Nice-to-Have: Such as a large yard, recent renovations, community amenities – these are desirable but won’t necessarily impact your final decision.

Once you’ve figured out these basic needs, you can start looking for a real estate agent.

You can send your compiled list to 2-3 agents, schedule a 30-minute call with each, and listen to their recommendations on which areas suit your needs, along with their own understanding and experience of those areas. Finally, choose an agent who both understands your requirements and is familiar with the local market. We previously released a video on how to choose an agent; feel free to watch it if needed.

After selecting an agent, you will sign a buyer agency agreement. This is required by the Department of Licensing after January 1, 2024.

Completing this step will make the subsequent steps of buying a home much smoother.

📃 Step 2 | Pre-Approval

If you need a mortgage, the second step is to obtain a pre-approval letter. This primarily confirms your loan eligibility and the approximate amount you can borrow. The bank will assess your financial situation to determine how much you can borrow, the interest rate, and the monthly payment.

At this stage, the bank generally needs to understand your income, debts, and credit history. They will also ask about your intended down payment amount and whether the funds are ready.

Upon approval, you will receive a Pre-Approval Letter specifying your loan amount, type, and validity period (usually 60-90 days).

It is possible to apply for a loan without U.S. income, but the down payment ratio and liquidity requirements will be higher, typically 35-40%.

Having a pre-approval letter makes your purchase offer more compelling to sellers.

🏠 Step 3 | House Hunting

Then comes the house viewing stage. The first task is for your agent to create a shortlist based on your needs: filtering out several potentially suitable properties within your specified price range and areas, scheduling viewings, and taking you to see them.

Generally, most buyers view 15-30 houses before finding the most suitable one.

Based on our experience, a smooth house hunting process usually takes 1-2 months, though some people may look for much longer, perhaps even a year or two.

Our recommendation is to schedule viewings 1-2 times per week, seeing 3-5 properties each time. This prevents “house fatigue” and confusion caused by overly dense viewings.

💰 Step 4 | Make an Offer

Once you find a house you like, your agent will help gather information about the property, analyze market data, and provide reasonable offer advice.

When making an offer, you need to sign the Purchase and Sale Agreement and related Addendums. These documents specify the price, timelines, and various protective contingencies.

Common contingencies include inspection contingency, loan/financing contingency, appraisal contingency, and title review contingency. These clauses protect your interests under specific circumstances.

When submitting the offer, you also need to include the Pre-Approval Letter and proof of down payment funds.

If the seller is unsatisfied with your offer and terms, they may propose a new offer and terms, known as a counteroffer. You can choose to accept, reject, or make a new counteroffer.

✍️ Step 5 | Mutual Acceptance

Once both parties agree on the price and terms and sign confirming this, this point in time is called Mutual Acceptance. The signing date becomes “Day 0”. From this day, all clocks in the contract start ticking, including key deadlines for inspection, loan processing, appraisal, etc.

The first thing to do is to wire the Earnest Money (typically 3%-5% of the purchase price) into the Escrow within 1-3 business days as stipulated in the contract. The earnest money will eventually become part of the down payment. If you withdraw under terms allowed by the contract, it is usually fully refundable. If you breach the contract unconditionally or miss deadlines, the earnest money may be forfeited.

After completing these steps, you can proceed to the next stage – the Inspection.

🔍 Step 6 | Inspection

If your contract includes an inspection contingency, schedule a professional home inspector immediately after mutual acceptance. Your agent can recommend inspectors, but you should also screen them yourself. Before the inspection, confirm the inspector’s qualifications, scope of inspection, and whether specialized inspections are needed (e.g., sewer scoping, mold testing).

It’s best to be present during the inspection to discuss findings with the inspector, including the home’s structure, systems, maintenance condition, foundation, roof, electrical, plumbing, HVAC, etc. The inspector will usually email a detailed report with photos the day after the inspection.

After receiving the inspection report, your agent will help identify major issues. You can then request the seller to repair these issues or offer a price reduction (credit).

Since, as the buyer, you can typically withdraw at any time during the inspection period (contingency), it’s crucial your agent reminds you of all deadlines to avoid missing them. After all, this “get-out-of-jail-free card” has a time limit.

🏦 Step 7 | Loan Underwriting

Simultaneously with the inspection, you need to finalize your choice of lender (bank or mortgage company). The contract usually requires submitting the formal loan application within 5 days of mutual acceptance. Therefore, it’s generally advised to shop for mortgages (compare rates and fees from various banks/lenders) intensively within 3-5 days. After choosing a lender, the loan enters the underwriting phase. During this process, the bank’s underwriter will review your income, debts, assets, credit, and also evaluate the property you are purchasing – this is the Appraisal.

The Appraisal is conducted by a third-party to assess the property’s value. As the buyer, you pay the appraisal fee but cannot choose the appraiser, ensuring independence. Unlike the inspection, the appraisal focuses on the home’s market value. The appraiser compares recent sales of similar properties nearby with the subject property’s features and condition. If the appraised value equals or exceeds the purchase price, congratulations, it indicates you didn’t overpay. If the appraised value is lower than the purchase price, the bank will only lend based on the lower value. You, as the buyer, can then choose to increase your down payment or have your agent renegotiate with the seller.

Of course, it’s worth noting that appraisers are human, so the appraisal result, much like your agent’s market analysis, involves subjective factors and judgment. The appraised value is just a reference for market value, but the bank needs a relatively objective number to assess its risk.

If everything proceeds smoothly, the bank will typically issue a “conditional approval” first, followed by a list of required documents. After you submit all necessary documents, provide proof of homeowners insurance, and everything is approved, the bank will issue a “Clear to Close” notice, indicating readiness for closing.

📁 Step 8 | Escrow Closing Preparation

During the closing preparation phase, the Escrow company prepares all necessary documents and reconciles the accounts. Main steps include:

Firstly, Escrow prepares the Settlement Statement (ALTA/Closing Disclosure), detailing all costs. You need to compare this statement with the lender’s Closing Disclosure (CD) to ensure all figures match.

Secondly, you need to prepare funds for transfer. Confirm wire transfer limits and deadlines with escrow, and reserve some buffer funds for possible minor adjustments.

Thirdly, you need to schedule a time to sign documents, usually 1-2 days before closing. Remember to bring valid photo ID.

Fourthly, conduct a Final Walk-Through 24-48 hours before closing. You and your agent will enter the property to confirm its condition, ensure agreed-upon repairs are completed, and cleaning is done.

Finally, remember to arrange for utilities transfer or setup (water, electricity, gas, internet), mail forwarding, etc. After these preparations, you can proceed to the formal closing.

🔑 Step 9 | Closing

On closing day, several things happen: First, the title company confirms receipt of the signed documents from the buyer and the wired funds due. Secondly, they confirm whether the bank has successfully funded the loan. If documents are complete and funds received, the title company submits the transaction to the county government for final recording, completing the transfer of ownership. Once the Recording Number is obtained, it signifies the transaction is officially closed. Congratulations, you are now officially the new homeowner!

Many clients ask us, “Buying a house here seems lacking in ceremony; closing is just an email confirmation.” That’s indeed true. In the U.S., deeds are stored electronically. Some title companies may mail you a copy of the title policy documents within a few months after closing for your convenience.

After official closing, your agent will schedule a time with you at the property for key and item handover. Remember to collect all keys, garage door openers, mailbox keys, and access codes. At this point, the home buying process is successfully complete!

🧮 Home Buying Costs

Having walked through the process, let’s look at the costs involved.

Home buying costs are mainly divided into “One-Time Expenses” and “Long-Term Holding Costs.” Here we focus on the “One-Time Expenses” for the transaction.

Using a $1 million house as an example, the costs are listed as follows:

First, the Down Payment: If 20%, that’s $200,000 (this includes the earnest money mentioned earlier).

Next, Loan Costs: These include loan origination fees, appraisal fee, credit report fee, totaling approximately 0.5% of the home price. For $1 million, that’s about $5,000.

Then, Title Company Service Fees and Prepaid Items: These generally include the title company’s closing/escrow fee, and prepaid items like property taxes and insurance premiums, also around 0.5% of the home price. For a $1 million house, that’s about $5,000.

In Washington State, most of the time, the seller pays the buyer’s agent commission.

So, finally, if you buy a $1 million house, you need to prepare approximately $210,000 to $220,000 in cash, including the down payment.

📢 Summary

Today, we’ve covered the entire home buying journey from defining needs to closing and getting the keys. The nine steps might not sound too difficult, but the actual process can be quite complex.

But don’t worry—a reliable real estate agent can guide you through every step of the process:

Helping you make plans and keeping track of all deadlines;

Reviewing documents and ensuring the security of your transfers;

Assisting with negotiations and risk control related to home inspections, appraisals, and contract terms;

And accompanying you during the final walk-through before closing.

Our team has years of experience in the Seattle area. So far this year, we’ve successfully closed over 100 transactions with a total value exceeding $150 million. We have in-depth knowledge of the Greater Seattle area and the entire home buying process, backed by a structured service approach.

If you’re considering buying a home in the Seattle area and want to navigate the process more efficiently and securely, feel free to send us a private message.

If you found this article helpful, please give it a like, save it for later, or share it with friends who might benefit. See you in the next post!