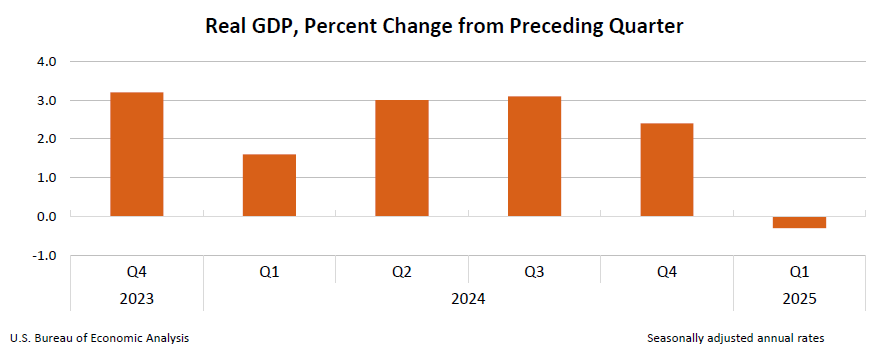

Recently, the U.S. Bureau of Economic Analysis released new data. And guess what?

The GDP in Q1 of 2025 actually shrank by 0.3%. That’s the first drop since 2022. One quarter of negative growth might not sound like much, but in economic terms, it’s a yellow warning sign. If it happens again next quarter, we’ll officially be in a recession.

Some people have been asking me: “Hey Maggie, if a recession is coming, should I still buy a house?” “Or is it time to sell?”

So today, I want to walk you through what’s really going on—what the latest economic data and real estate numbers are telling us—and share my honest thoughts.

Before we dive in, I’m Maggie, leader of one of Seattle’s top real estate teams. Last year, we completed 148 transactions with over $180 million in total sales. Whether you’re moving for work, a fresh start, or your dream home, we’re here to help you make it happen!

OK, let’s get started!

First, let’s talk about what’s happening in the Seattle housing market.

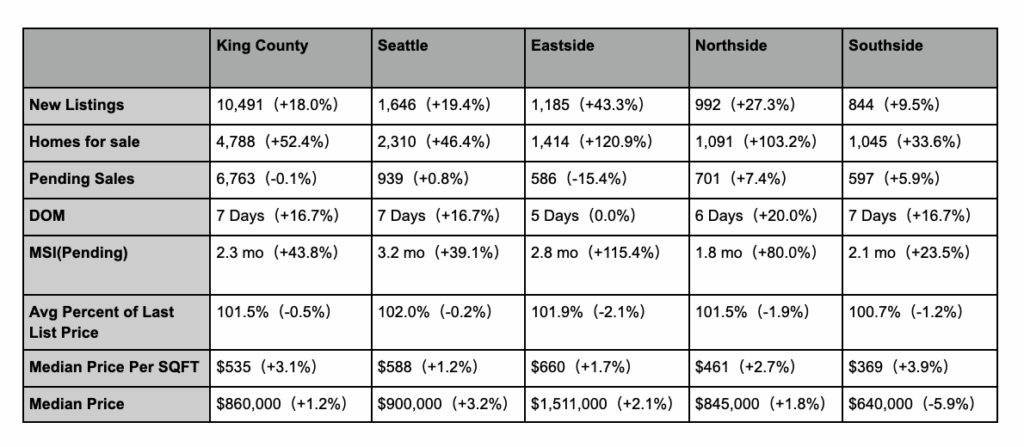

In April, new listings jumped. In King County, we had over 10,000 new homes hit the market—that’s an 18% increase from last year. On the Eastside, listings were up 43%.

Sales? Flat overall. About 6,763 homes sold—pretty much the same as last year. But on the Eastside, sales dropped 15%—so yes, it’s cooling down there.

Inventory also spiked. Compared to last spring, we have about 50% more homes for sale. In some areas,like Eastside, inventory has doubled.

Seattle now has about 3.2 months of housing supply, Eastside has around 2.8 months. A balanced market is usually 4 to 6 months, so while sellers still have some power, the market is shifting.

Now I know what you’re thinking—what about prices?

Well, even with more homes for sale, the prices data still show steady. The median price is up just 1.2% compared to last year, and the price per square foot rose 3.2%.

But in my opinion, the reason why prices haven’t gone down despite the high inventory is because home prices are based on properties that have already closed. There are still a lot of unsold homes sitting on the market. And if they stay unsold for too long, sellers might lower prices, which will eventually show up in the data as a price drop.

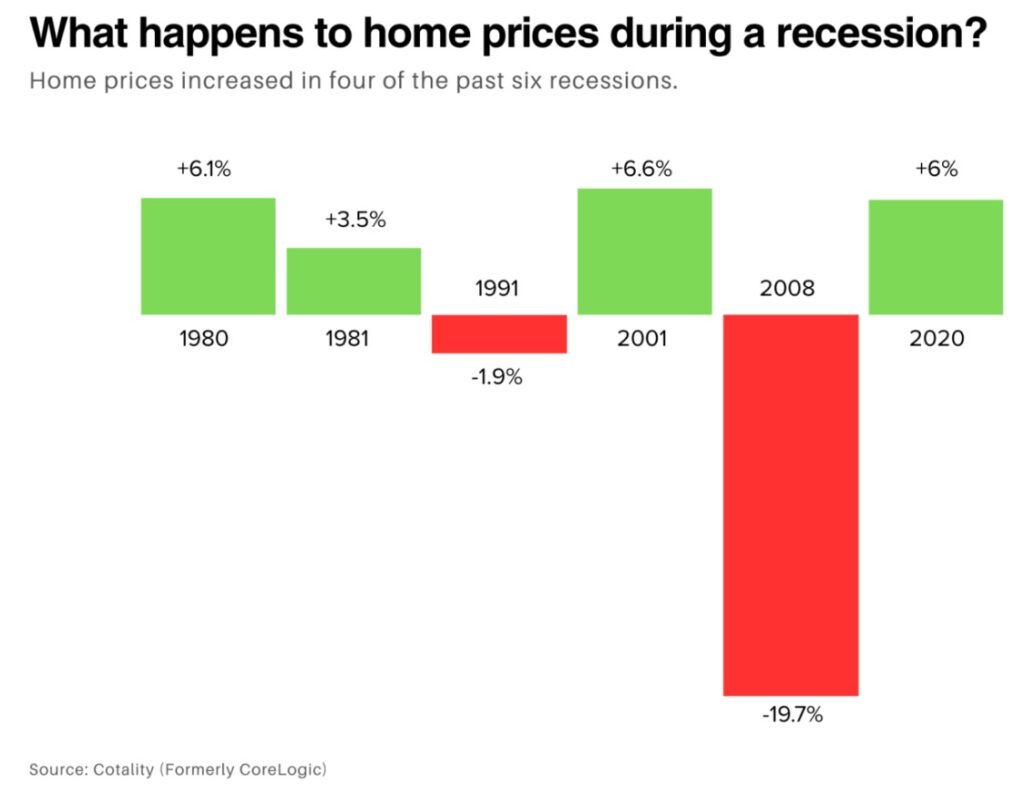

Now let’s zoom out—What happens to home prices during a recession?

A lot of people think of 2008, when prices crashed nearly 20%. But history tells a different story.

In the last six U.S. recessions, only 2008 did we see a true collapse. So what is the takeaway? Recession doesn’t always mean falling home prices.

Today’s market is also very different from 2008. Lending is stricter, buyers are more qualified, and there’s actually a housing shortage, not an oversupply.

The Washington state government says we’re facing a serious housing shortage. By 2044, the state will need over 1.1 million new homes to meet demand. That’s why Seattle is now pushing Bill HB 1110 to allow more housing in each area.

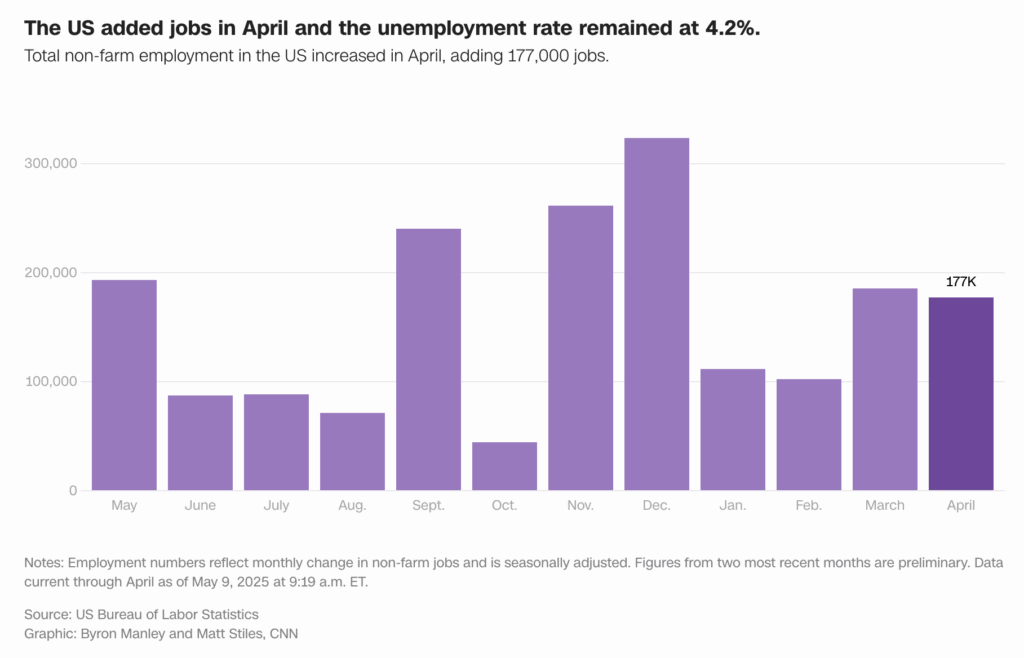

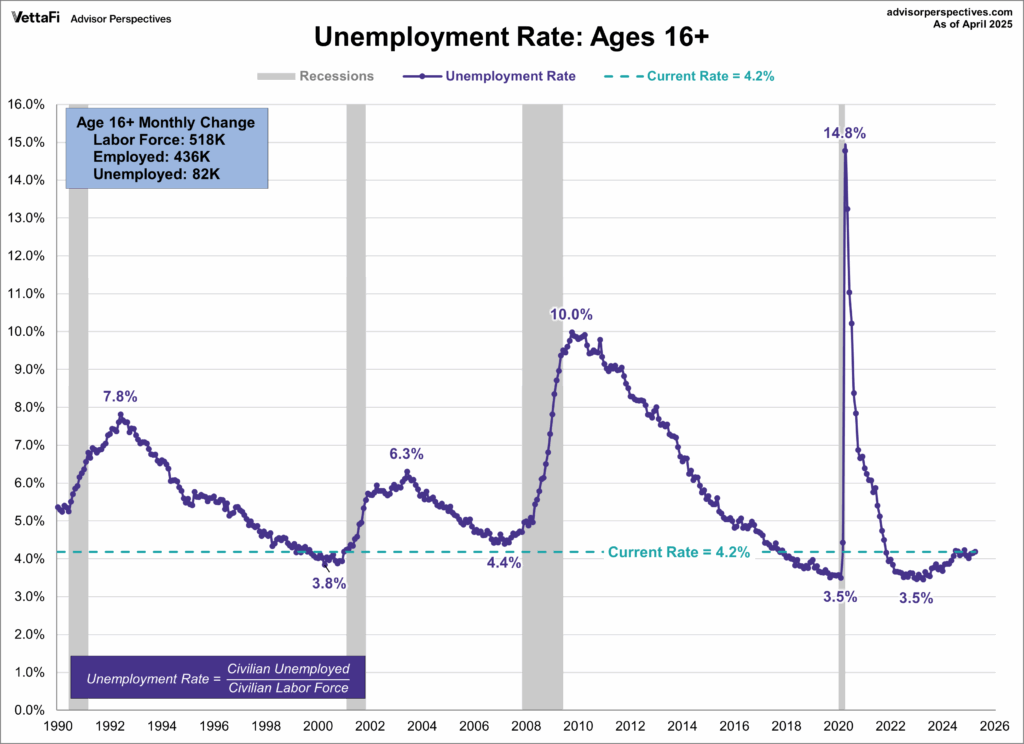

And the job market is still strong. In April, we added 177,000 jobs in the USA, which is beating expectations. Unemployment rate is still low—4.2% nationally, 4.4% in Washington. So no, buyers aren’t just disappearing.

Let’s talk interest rates.

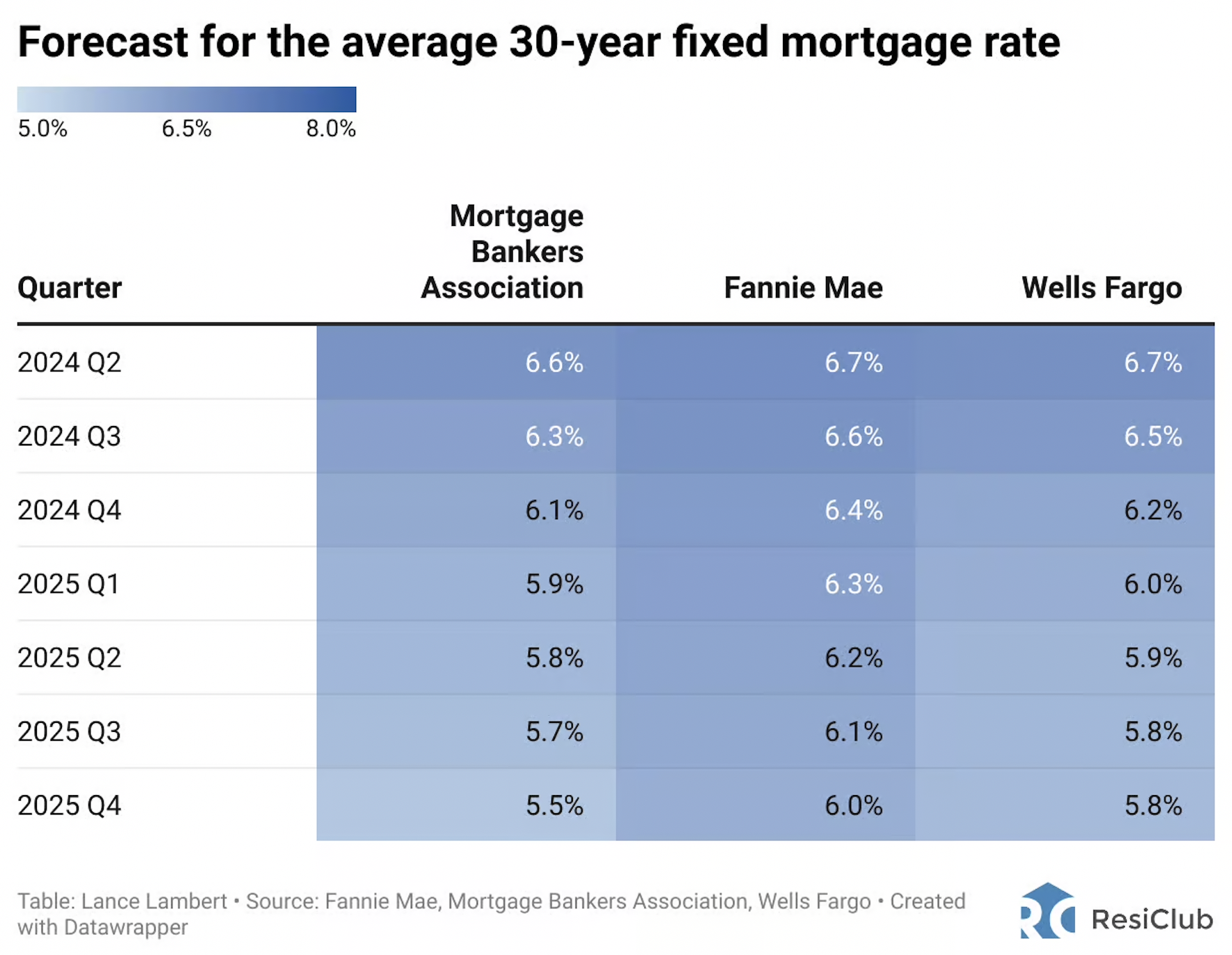

Yes, they’re high—around 6% to 7%—but the Fed’s stopped hiking for now. And some experts predict rate cuts later this year or next. If that happens, mortgage rates could drop, bringing more buyers in.

Also, real estate is more stable than stocks. Stocks react fast—up, down, panic. Housing moves more slowly. It’s less volatile.

Of course, here in Seattle, tech stocks matter. A lot of Eastside buyers work in tech. So when the stock market dips, real estate there slows down too.

But overall, I’m feeling cautiously optimistic. Prices might soften a bit, sure. But a big crash? Very unlikely.

Now I know what some of you are thinking:

“Maggie, aren’t you just saying this to get people to buy houses?”

But here’s the truth—I say this because I truly believe it. I want to be in this business until I’m 80. I’m not here to fool anyone.

Warren Buffett once said, “Be greedy when others are fearful.” That works in real estate, too.

Right now, the market is slower, buyers have more power. If your finances are solid, this could be a great time to make a smart buy.

One of my assistants just found her dream home—lake view, tennis court, and all within budget.

Now, a few quick tips if you’re buying right now:

- Go see more homes. Now, the inventory is up. You’ve got time to compare, learn, and spot a good deal.

- Watch the rates. Some clients recently locked in 5.125% jumbo loans—much better than the headlines. So you can always talk to your agent and lender, and stay updated.

- Don’t be shy about negotiating. Sellers are more flexible now. You can ask for a lower price, closing cost help, or repairs.

- Be smart with your budget. You must have at least 6–12 months of savings ready. Don’t stretch too thin—plan for what-ifs.

These are my real, honest tips.

So, what do you think? Will a recession happen this year? Leave a comment, let’s talk about it.